Bike Drawing Picturesworkshop Home Office Deduction

Find, Read, And Discover Bike Drawing Picturesworkshop Home Office Deduction, Such Us:

- Specialized Tarmac Sl6 Sport Disc Road Bike 2021 Sigma Sports Bike Drawing Picturesworkshop Home Office Deduction,

- Past Events Uofl Sustainability Bike Drawing Picturesworkshop Home Office Deduction,

- Are Insurance Payments Tax Deductible Infographics Article Bike Drawing Picturesworkshop Home Office Deduction,

- Https Www Hsph Harvard Edu News Decision On Convalescent Plasma For Covid 19 Raises Questions 2020 08 28t13 04 50 00 00 0 Weekly Https Cdn1 Sph Harvard Edu Wp Content Uploads Sites 21 2020 02 Big 3 Howard Koh 470x313 Jpg Big 3 Howard Bike Drawing Picturesworkshop Home Office Deduction,

- How To Clean And Lube A Bike Chain Bikeradar Bike Drawing Picturesworkshop Home Office Deduction,

Bike Drawing Picturesworkshop Home Office Deduction, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Are Insurance Payments Tax Deductible Infographics Article Bike Bag Sewing Patternacara Workshop Entrepreneur

By wolf richter for wolf street.

Bike bag sewing patternacara workshop entrepreneur. What you can and cannot claim. The home office deduction is available to renters and homeowners alike. To be eligible for a wfh tax deduction your recurring expenses must be.

But first what is a home office. Basically if you meet the technical requirements of the tax law you can deduct the cost of utilities rent depreciation home insurance and repairs when you use part of your home for business. Per the irs a home office must meet two.

There is no recovery for office space. You generally cannot create a loss from the home office deduction brosi says. There are three ways to fund an hsa and lower your.

With a treadmill desk you can walk and burn calories while you work. We feel your pain literally. Sure a standing desk is great for improving your posture but those wont help you get any closer to your goal of 10000 steps every day.

Home office expenses if you use part of your home regularly and exclusively as an office. Suppose the gross income from your business is 10000 and you have 1500 in home office expenses and 9000 in. The number of people going to the office has declined over the past four weeks.

If you have an online business youve probably heard that it can greatly reduce your tax liability. Lets make sitting while working a thing of the past. Real you spent the money on this expense.

The trend towards working from home and at home is expected to gain massive ground in the wake of the covid19 crisis and will make the home office a feature of many more homes big and small. The money in the hsa is yours to keep and use even if you switch plans. For your home office furniture you can claim for a deduction that costs 300 or more by calculating the decline of owned assets for the income year and assets used for work related needs.

You can draw on the account to pay for out of pocket health care costs. And according to the irs your home can be a house condo or apartment unit or even a mobile home or boat as long as you can cook and. Spend most of your day at a desk.

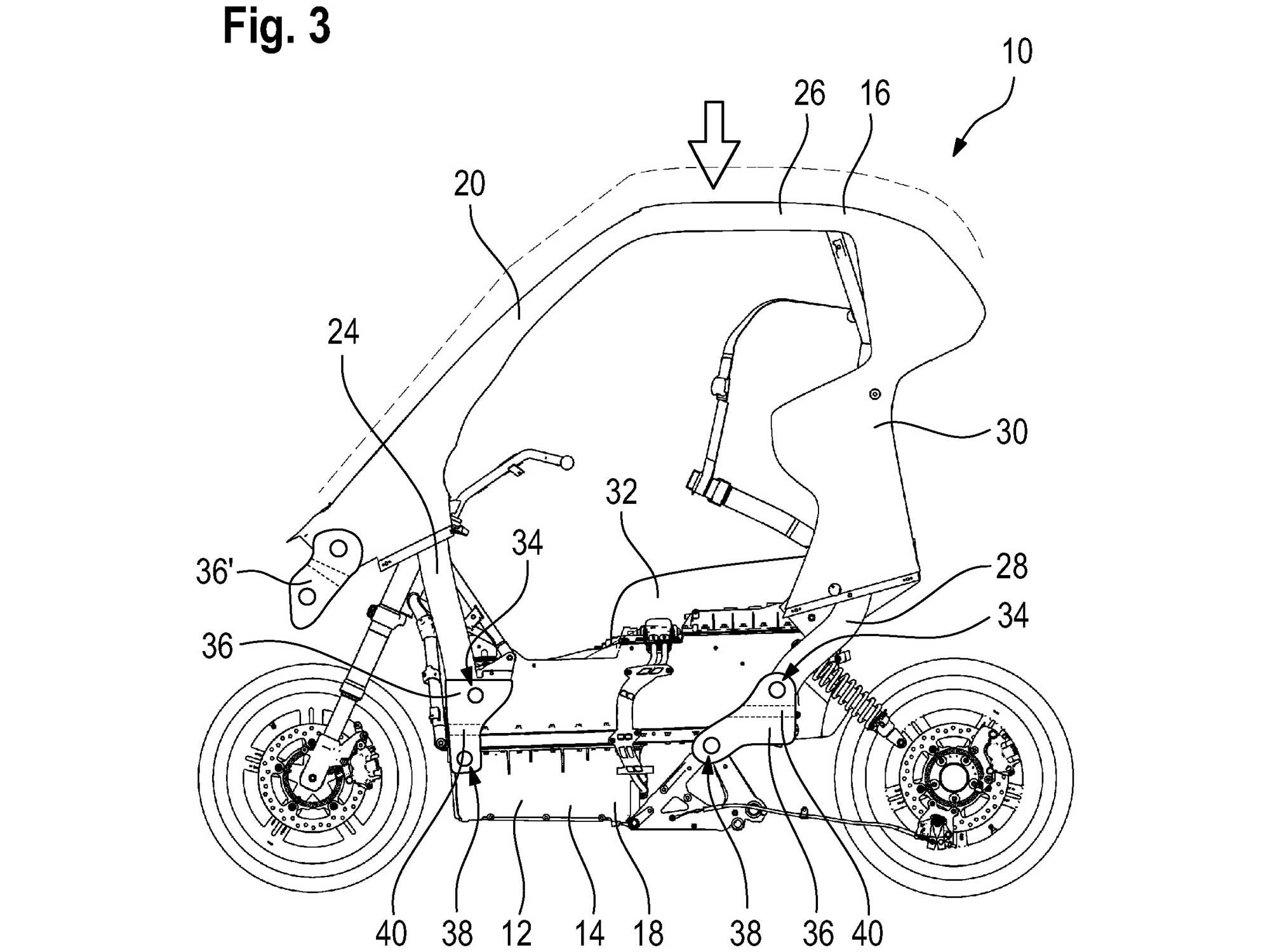

The explosion on the scene of work from home in reaction to the pandemic as measured by people suddenly not entering office buildings can be tracked by collecting data from access control systems for offices such as keycards key fobs and. Ah the magical home office deduction. The deduction is available not only for a home office but for other business uses as well such as a workshop or studio at home.

Five Top Tips For Doing Your Own Books Start Up Donut Bike Bag Sewing Patternacara Workshop Entrepreneur

More From Bike Bag Sewing Patternacara Workshop Entrepreneur

- Bike Design Lockgmod Workshop Vr

- Tired Body Quotesquickest Bolt Action Rifle

- Spill Error Excel If Function

- Folding Bike Anatomyworkshop Design Floral

- Error 404 Gif

Incoming Search Terms:

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland Error 404 Gif,

- Brompton H2l 2 Speed E Bike Pure Electric Error 404 Gif,

- The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto Error 404 Gif,

- The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto Error 404 Gif,

- Hop Into Art Weekend Family Workshops At The Edward Hopper House Error 404 Gif,

- Urban Sketchers Error 404 Gif,